Selling your home can be a complex process. Even just thinking of selling may feel overwhelming. But with proper preparation, you can streamline the process to achieve the best possible outcome. Here are some essential insights and tips to help you get started.

Setting the Stage for Success

Before you put your home on the market, it’s crucial to make it as appealing as possible to potential buyers. Have a local agent conduct a free Comparative Market Analysis. By doing so, you can see how your home compares to others in your neighborhood and in your region (like Western WA). You’ll also be able to discuss repairs and possible upgrades or renovations that would increase your home’s listing price.

Additionally, you should analyze your home’s exterior at a glance. Your home’s curb appeal can easily be boosted with a bit of yard work, window washing, power washing, and/or re-painting the exterior. First impressions are everything, especially since the majority of home buyers view homes online first. So, those professional photos are key. Your agent should have a great photographer, but nothing takes the place of properly preparing your home for the market.

Decluttering and staging are also crucial to success. Even partially staging your home can help. Buyers should be able to easily imagine what it would be like to live there. While we completely understand filling your home with mementos, when it’s time to sell, your home should actually be de-personalized. Give buyers the space to put themselves in your home. Staging can also help enhance your home and draw buyers’ attention to certain features. A pop of color can help Buyers may notice a beautiful bay window thanks to a pop of color. A carefully crafted living room will feel more bright and spacious.

A Pre-Listing Inspection

A pre-listing inspection can increase efficiency and transparency with potential buyers. By presenting a pre-listing inspection up front, buyers will be able to really understand a home’s condition and see that you have nothing to hide. This increases buyer trust and can eliminate the need for a buyer’s inspection.

Assistance with Repairs/Upgrades

Want to make repairs and upgrades before selling your home but don’t have the means to do it all? Consider the Windermere Ready Program. This program allows you access equity in the home before you sell it so that you can cover home improvement costs. One of our Windermere agents will help strategically prepare your home by identifying high-impact updates and they will help you through the entire process.

Pricing it Right

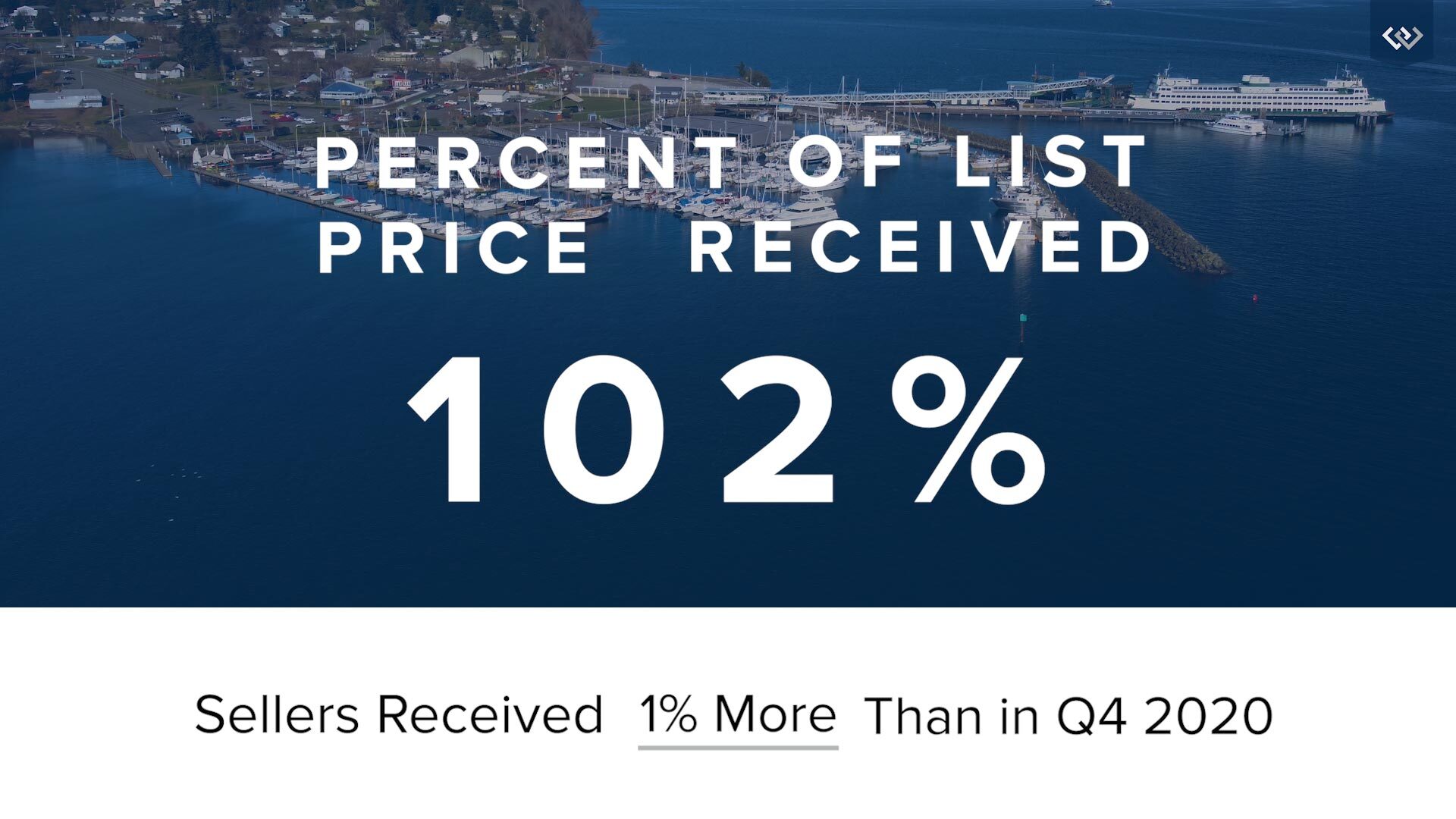

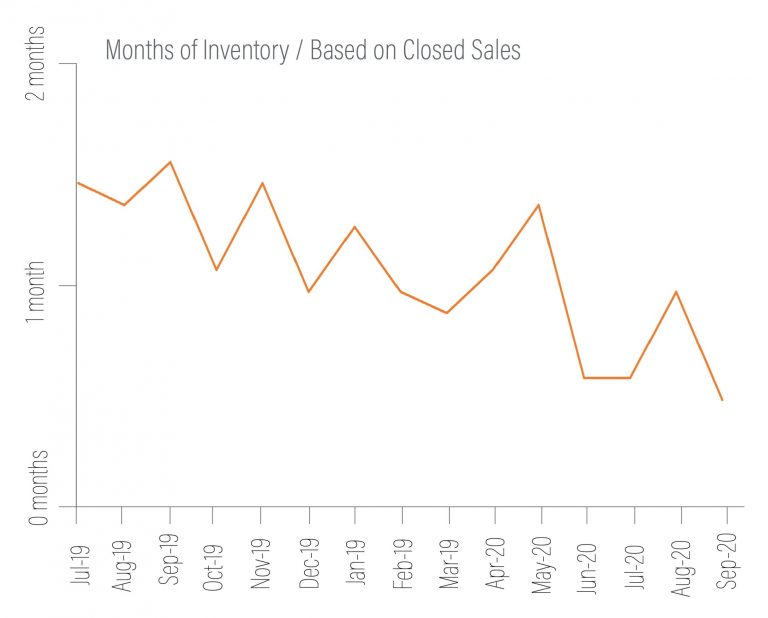

Determining the proper price for your home is a strategic decision that should be backed by local market research. Having a great local agent makes a huge difference. The last thing you want is for your home to be priced incorrectly. Again, we highly suggest having your agent do a free Comparative Market Analysis or CMA.

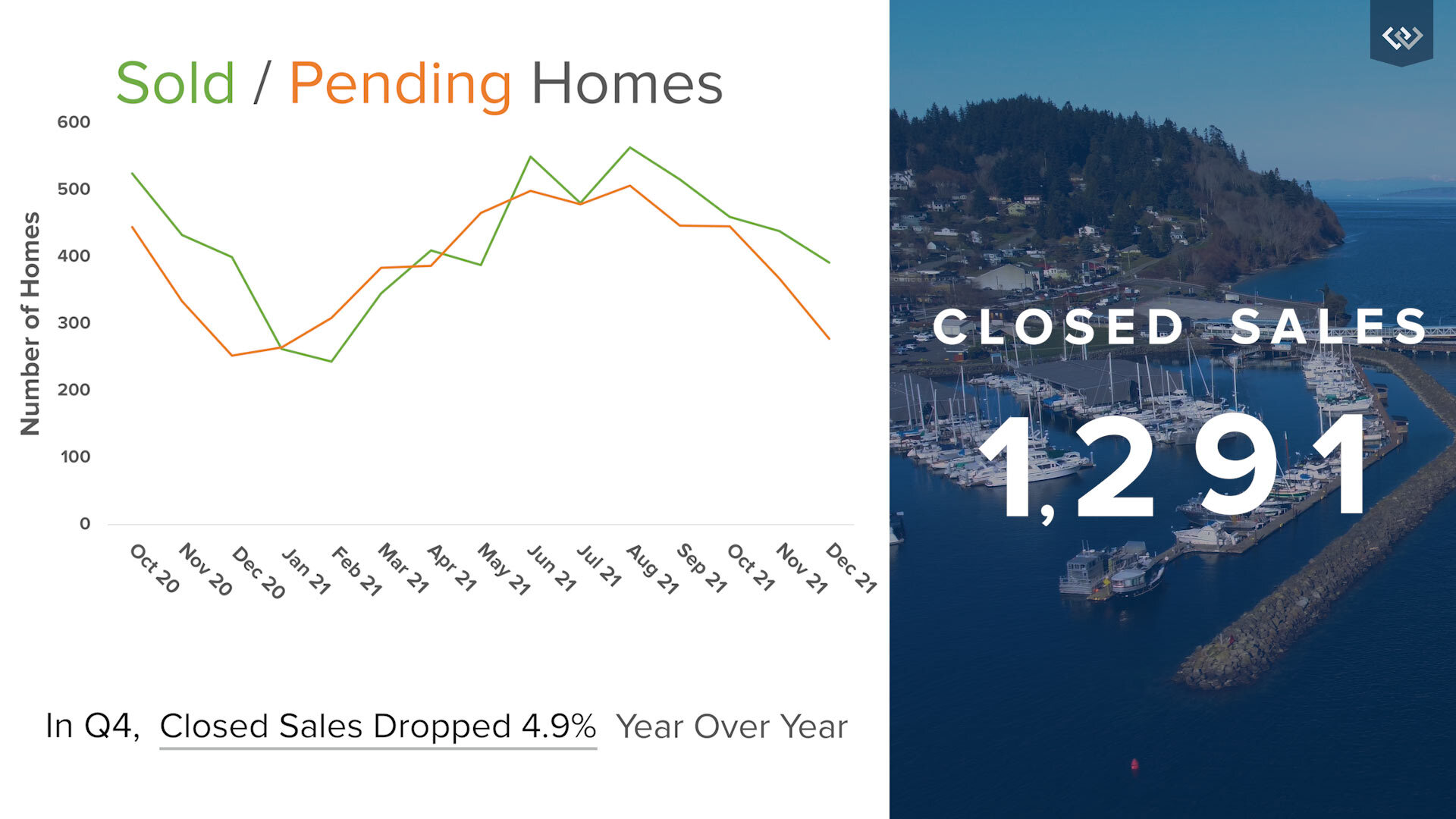

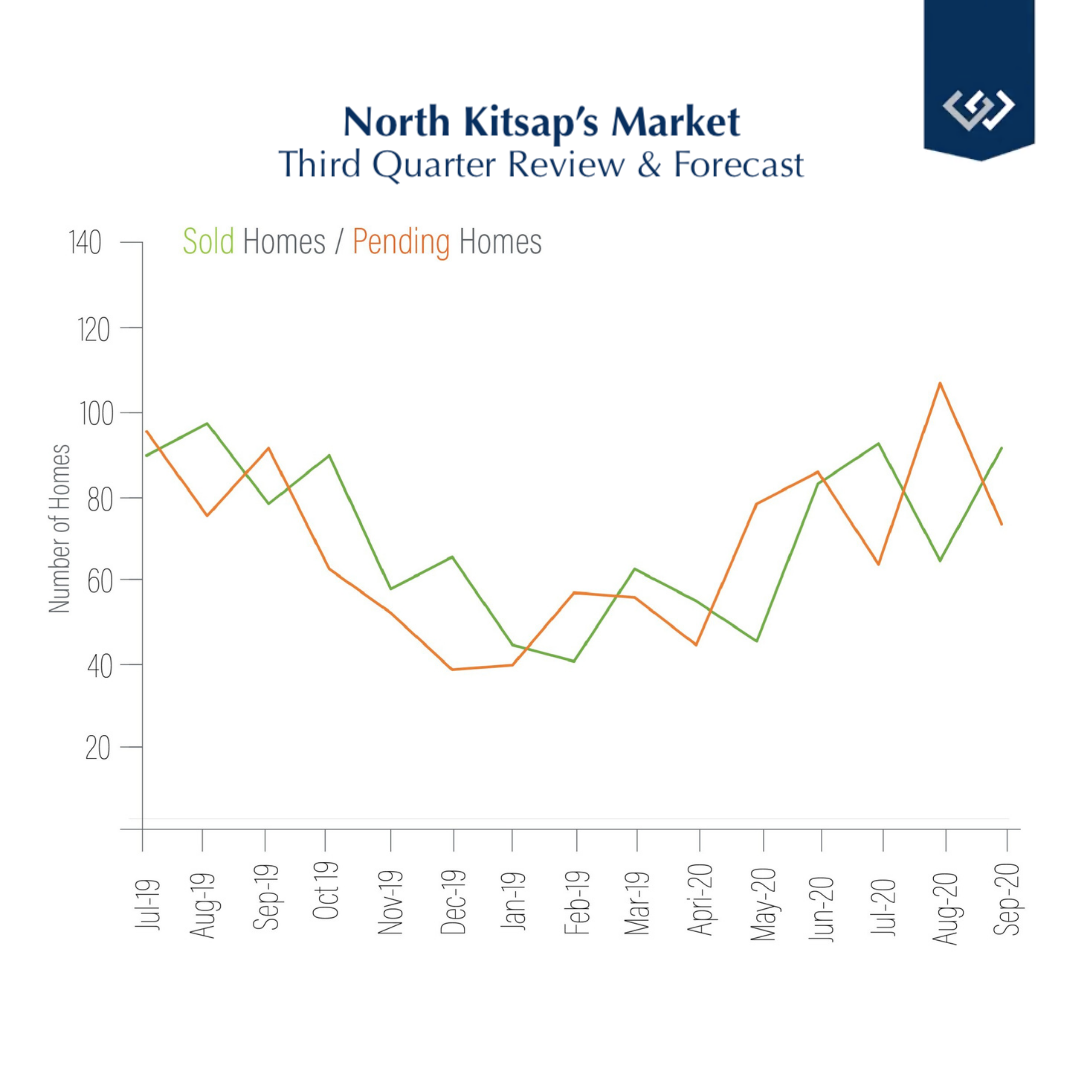

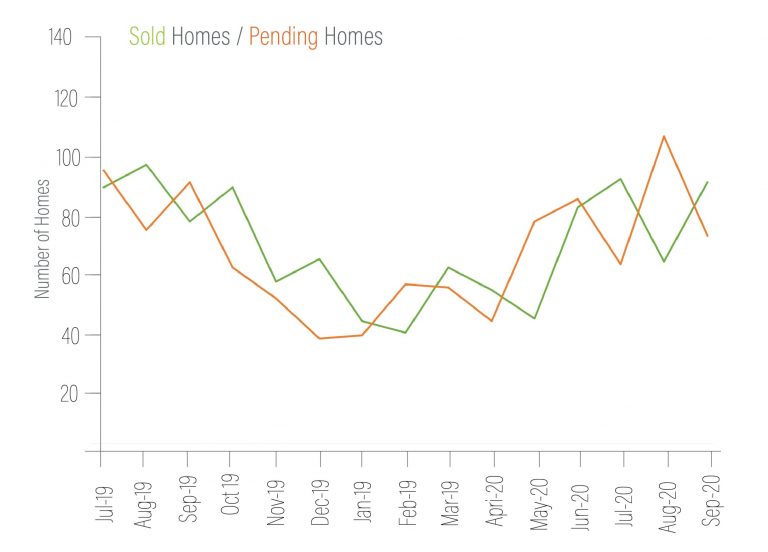

Here in Kitsap County, we have an interesting real estate market. So, it really pays off to work with someone who possesses local expertise and has a solid network. While there are great agents in many cities, if you don’t work with someone local, they may not know the local market well enough. This could lead to them overpricing or underpricing your home, and it would come into play when a buyer’s lender requires an appraisal to determine the value of your home.

Marketing Your Home

When you’re ready to list your home, effective marketing goes a long way. Our agents ensure your home is listed in the Northwest MLS with excellent professional photos and captivating descriptions. Your listing will be widely circulated across the internet on various listing websites as well as in print and on social media. Additionally, we market our premier properties through exclusive print and digital outlets. Our agents also have an in-house digital marketing team available to develop additional marketing strategies involving email and social media marketing campaigns.

Navigating Offers and Negotiating Terms

Receiving offers can be exciting. Sometimes they may come with unforeseen challenges. Your agent will be able to help you review offers. They will also discuss contingencies and develop strategies for negotiating counteroffers, and help you navigate multiple offers if that happens.

The Escrow and Closing Process

Once you’ve accepted an offer, the sale enters the escrow and closing phase. Home inspections, appraisals, and potential issues may arise. But if you have a great agent, this process will go more smoothly. It’s important to be aware of how selling your home may impact your taxes. As you prepare to move, your agent should be able to help you with a list of great local vendors such as moving companies and cleaners.

Successfully selling your home involves careful planning, effective communication, and informed decision-making. By following this comprehensive guide, you’ll be better equipped. And remember, each step you take brings you closer to achieving your real estate goals.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link