Looking for the latest information about Kitsap County’s real estate market? This market update gives you fourth quarter stats, an overview of the last five quarters, and some important insights from Windermere’s Chief Economist, Matthew Gardner.

As was expected, our local market slowed down as we entered the holiday season. There are still many eager buyers in Kitsap County, but inventory remains low. As a result, sellers still have the upper hand.

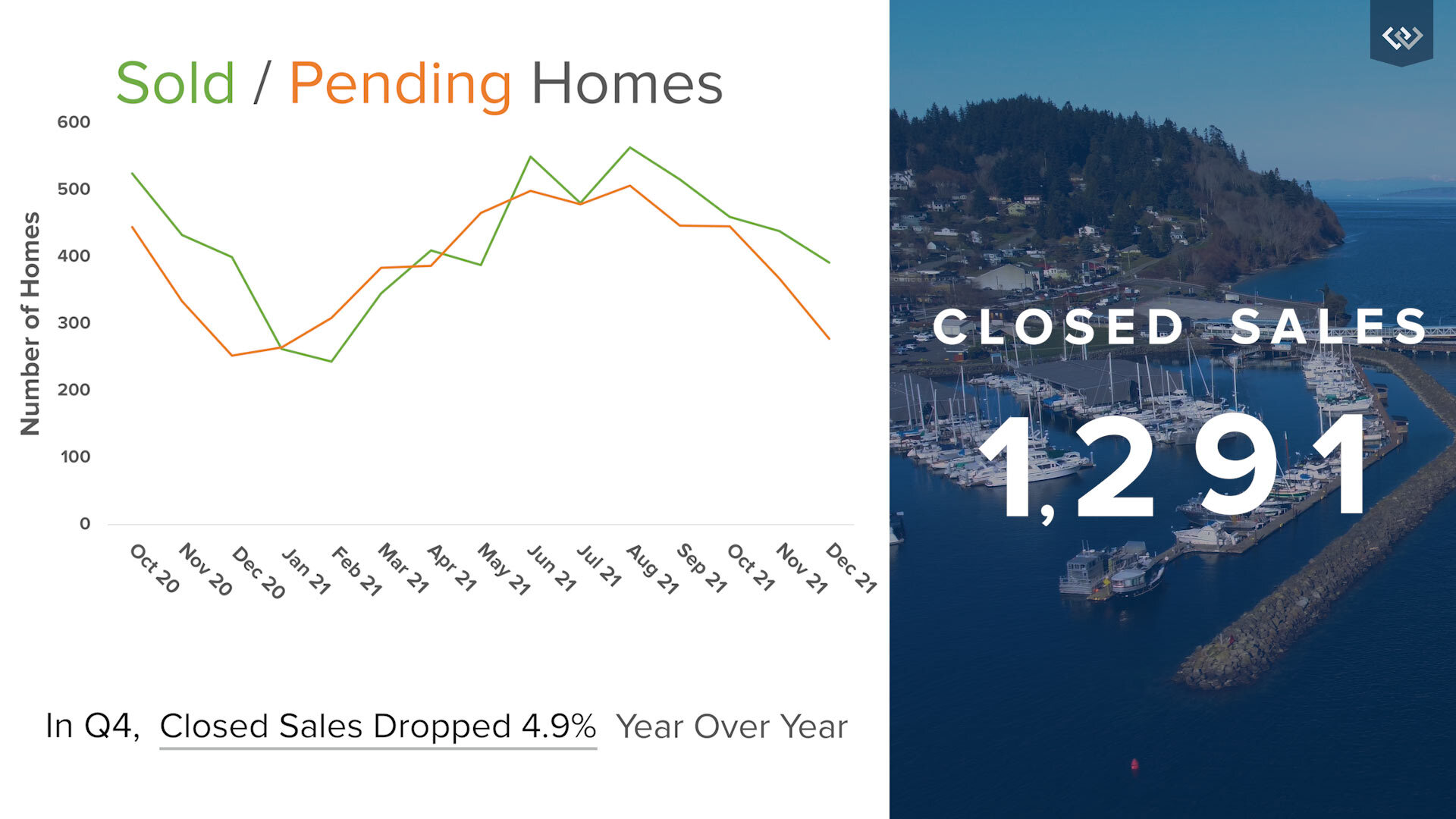

A Look at Sold and Pending Homes

When looking at the last five quarters in the graph above, you can see summer’s growth trend and winter’s seasonal slowdown. Due to high demand, home prices continue to rise, and sold homes are still outpacing pending listings. Our seller’s market saw a 4.9% decrease year over year in closed sales during 2021’s fourth quarter, and we had a total of 1,291 closed sales.

Our Strong Seller’s Market

Since remote work has become the focus for many people, buyers are often drawn to places that are near big cities but far enough away to enjoy a peaceful, connected lifestyle. Kitsap County offers that and much more. So, demand in our area remains strong. It’s a great time to sell if you’re a local considering a move. If you’re a buyer wanting to move here, learn about Kitsap County in our free digital guide. If you have any questions, our local experts are here to assist you.

Listing Price vs. Sale Price

Currently, most buyers are able to pay at or above the listing price for a home in Kitsap. However, demand is pushing the cost of housing even further in favor of sellers as inventory remains low. In our fourth quarter, Kitsap County’s average sale price was $613,000, an 11.3% increase year over year. While this is very beneficial for sellers, many are voicing affordability concerns.

Insights from Our Chief Economist

Looking at the broader real estate market, we have insights from Windermere’s Chief Economist, Matthew Gardner. In his most recent Monday with Matthew, Gardner shared his market forecast for 2022: “If everything goes according to my plan, you should expect to see the housing market start to move towards some sort of balance next year, but I am afraid that it will still remain out of equilibrium until at least 2023.” This is an important reminder that the transition back to a balanced market will be a gradual shift.

While Gardner ensures us that he “doesn’t see a housing bubble forming,” he is concerned about housing affordability. There is definite cause for concern among the millennial generation as they start to settle down more and more. Millennials are currently the largest group in the generational real estate market, so it will be interesting to see where affordability and demand intersect.

In his video, Gardner concluded by saying, “demand for ownership housing remains remarkably buoyant and, in fact, it is quite likely that demand may actually increase with the work from home paradigm that will start to gain momentum next year.” In light of this, real estate continues to be an excellent investment.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link