Unique Movie Theaters in Our Area

Many interesting movie theaters in our area have a long, rich history and offer a variety of movies for patrons to enjoy. Whether you want to watch a newly released blockbuster, take in an independent film, or attend a special event, here are some great places to check out.

Firehouse Theater in Kingston, WA

This business earned its name because it is located in a historic firehouse in downtown Kingston. It specializes in first-run, independent, foreign language, documentary, and classic films. With only two screens, it is an intimate venue with many movie conveniences such as concessions, real butter popcorn, beer, wine, and seltzer. Check out their website to see what’s playing.

Special screenings include $7 tickets on Wednesdays, open-caption screenings on Monday afternoons, and Inside the Art House viewings. Inside the Art House is a new video podcast that discusses the insider’s perspective of filmmaking, hosted by Greg Laemmle and Raphael Sbarge.

Drive-in Theaters in Port Townsend and Bremerton

If you’re looking for a fun flashback, consider going to these drive-in movie theaters. Port Townsend’s Wheel-In Motor Movie has been open since 1952. It invites guests to come watch the stars under the stars. Guests listen to the movie through an FM radio station, so make sure yours is in good working order. They also offer a concession stand. Check out their Facebook page and website for current and upcoming showings.

The Rodeo Drive-In Theater in Bremerton is another blast from the past. Established in 1949, it is the largest drive-in theater in the Pacific Northwest with three screens. Each screening includes two first-run features. It’s a great way to watch those newly released blockbusters. Guests can also grab a bite to eat at their concessions stand or take advantage of online ordering for pick-up at a specific time. Check out their website and Facebook page for current showings.

Anderson School Theater in Bothell

If you want to travel a bit (or even make a weekend of it), consider the Anderson School Theater in Bothell. Hop on the ferry from Kingston to Edmonds, and take a short drive to the McMenamins at Anderson School. This McMenamins location offers not only a theater but also a hotel, restaurants, and even a pool.

The theater has an old-world charm. You can order pizza, burgers, drinks, and beer from their brewery, which can all be delivered to your seats in the theater. If you need any hearing or visual accommodations during the show, let a theater employee know. They have closed caption devices and two unique headphone sets. One set amplifies the volume of the dialogue in the movie. Another headphone set describes the scenery and action to those with visual impairments.

Admiral Theater in Bremerton

The Admiral Theater in Bremerton hosts a mix of live theater and movie showings. Their live entertainment includes a wide variety of musical and comedic acts. However, their movie screenings often feature nostalgic films from the past that align with the season for only $5 a ticket. Check out their 2024-25 season brochure for a full list of performances and movie showings at this unique venue.

Roxy Theatre in Bremerton

The Roxy Theatre in Bremerton is the only nonprofit arthouse cinema in Kitsap County. At the Roxy, you can enjoy a mix of movies and live events, including live music. It first opened in 1941, and legends like Frank Sinatra and Bing Crosby performed there. After falling into disrepair in the 1980s, it has since been revitalized by the Roxy Bremerton Nonprofit Foundation. Now, it plays movies every day and even caught the eye of the Seattle Times, which recognized its rich history and current offerings.

Blue Mouse Theater in Tacoma

The Blue Mouse Theater in Tacoma’s Proctor District opened in 1923. Over 100 years old, it is the oldest continuously operating theater in Washington state. It has a fascinating history and now aspires to be a community space. In addition to movie showings, it is also available for rent for events, performances, and private parties.

The theater shows first and second-run movies. In addition, it hosts monthly film events. For example, Anime Theater happens on the first Friday of the month. If you’re really into scary movies, Friday Night Frights is a long-standing tradition at the theater. It shows a horror film every 3rd Friday of the month beginning at 10:00 PM. The theater also has your standard concession items for sale, along with beer and wine.

Port Gamble Theater in Port Gamble (Coming Soon)

Port Gamble Theater is also looking to offer a mix of live theater and cinema. In August of 2024, they announced on Facebook that they are working on bringing cinema back to this historic theater. After hosting the Port Townsend Film Festival, they declared they are fundraising for capital improvements to bring this vision to life. Donations can be made here.

We’re fortunate to have many great entertainment options to relive cinematic history, enjoy a current hit, or experience a unique night out. If you want to explore our area further, check out our Guide to Kitsap.

Bridging the Past and Future: The Kingston Historical Society

If you’re familiar with Kitsap County, you may be able to look at the photo above and recognize the Kingston ferry dock. But this photo, taken in 1965 and courtesy of the Kingston Historical Society, also points to Kingston’s maritime roots. Our town has a rich history and a strong community. In fact, Kingston was part of the early days of the Mosquito Fleet, and settlers were known for their love of clams. Additionally, the port district recently celebrated 100 years of car ferry service to Edmonds. Downtown Kingston was first developed in the 1890s and continues to be a hub of wonderful eateries and small, locally-owned shops. A key connection between Kingston’s past and present is the Kingston Historical Society.

Ed Goodwin, one of our Windermere Kingston Brokers, is the current president of the Kingston Historical Society (KHS). We sat down with him to discuss the KHS. Ed has been involved for about seven years. “Soon after joining Windermere in early 2017, I attended the Discover Kingston event at the Village Green in Kingston, where I met De Mackinnon and Kathy Sole from the KHS. Having an interest in history, wanting to know more about the area, meeting new people, and looking to get involved in the community led me to attend a meeting and subsequently join the group.”

Mission & Vision

The Society’s mission is “To record, preserve, interpret, and display the history of Kingston, Washington.” History tells a story of the past, and through it, we can learn about the people and the decisions they made that shaped the world we live in today. By using that knowledge, we can make informed decisions that will improve our world tomorrow.

From Vintage Photos to a Published Book

In 2019, the Kingston Historical Society published Kingston (Images of America) through Arcadia Publishing. Ed was part of the book committee. He says, “It was an interesting experience for sure, something that I never thought I’d be involved with, but you never know what’s going to happen when you say yes.” The book has all kinds of fascinating information and vintage photographs. You can find copies of it at our lovely Saltwater Bookshop right here in Kingston.

Kingston Historical Society in the Community

The KHS has actively shared its stories with the community through displays at the Village Green, participating in local events, and getting the local youth involved. For example, Kingston History In Color was an event coordinated through Kingston High School. Art students were given copies of the book Kingston (Images of America), which includes all black and white photographs. Each participating student rendered a color version of an image in the book and included an artist statement. The results were fantastic. An artists’ reception showcased their work, it was judged, and awards were given.

Additionally, in March 2024, Kingston High School, in partnership with the Kingston Historical Society, held an exhibit on Kingston’s Japanese settlers during a multicultural event.

An established non-profit organization, the KHS was recently recognized as an anchor organization of the “Maritime Washington National Heritage Area.” Anchor organizations work to preserve the history and stories of our vast shoreline marine areas in Washington state.

Current Projects

The KHS plans to create a QR code walking tour. QR codes will identify local points of interest and link to the KHS website, where visitors can read expanded descriptions.

Ed also shared some exciting information: “The big news is that we are working on a new book!” Society members De MacKinnon and Jenny Loftus have spearheaded this effort and have done an incredible amount of research thus far. They are compiling data for “All in One Place: 100 Families from Kingston’s First 75 Years.” As part of this endeavor, back in February 2024, the Society hosted a hometown reunion at the Village Green. Approximately 80 people came together, met with others who grew up here, and shared their stories. It was a great success. The expected launch date of the new book is the summer of 2025.

Our Office’s Involvement

In 2023, we partnered with the Historical Society for a Community Service Day project at the Kingston Cemetery. The group that oversees the cemetery is another small volunteer group. They really appreciated the efforts of our Windermere staff and Brokers, who cut and cleared a ton of overgrowth.

Get Involved

A small group of enthusiastic volunteers runs the Kingston Historical Society. They rely on community support through memberships, monetary donations, historical memorabilia, grants, fundraising events, and revenue from book sales. They meet on the third Monday of the month at the Village Green in Kingston from 11:15 AM to 12:30 PM. All are welcome to attend. If you have any questions about the Kingston Historical Society, visit their website at kingstonhistory.org or email kingstonwahistory@gmail.com.

For more information about Kingston and Kitsap County as a whole, check out our digital Guide to Kitsap.

How to Financially Prepare as a First-Time Home Buyer

While there are many steps in the home-buying process, it’s best to start by reviewing your finances, especially as a first-time home buyer. In fact, you should do this long before you start looking at homes. While diving into your finances can feel daunting, our partner at Penrith Home Loans is here to help. Cherie Kesti is a Branch Manager and Mortgage Consultant who also happens to be a Kitsap County local. With more than 20 years of experience working in the home financing industry, she was happy to answer these common questions from first-time home buyers.

What are the top things lenders consider when working with a first-time home buyer?

There are a lot of things we look for when qualifying a first-time home buyer, but four key areas are:

- Job security: Having a minimum two-year history is ideal.

- Other income sources: This includes other sources such as social security, alimony, child support, disability, retirement, and pensions. For these types of income, lenders must confirm that the money will continue being received at least 36 months post-closing.

- Credit history and monthly debt load: Having a good credit score is an indicator of your overall financial health. If yours is low, it’s important to take steps to improve your credit score before applying for a loan. Also, the amount of outstanding debt directly affects how large a loan a buyer qualifies for. If you’re able to pay down your debt, that’s ideal before qualifying for a loan.

- Assets: Some loans require a minimum amount of assets in liquid accounts such as checking, savings, and money market accounts or in brokerage, retirement, and stocks. Borrowed funds are not considered an acceptable source of funds for a home loan unless those funds are secured by an asset such as a vehicle, or property.

Is buying a home still achievable in today’s market?

Many young adults think that they may never be able to buy a home. There is so much discouraging information in the media. However, they become more optimistic after learning that there are a variety of lending strategies and programs available to help first-time home buyers. This includes programs that allow a small down payment and gift funds from a family member to be used as a down payment. There is also down payment assistance available and the possibility of negotiating a seller-paid mortgage-rate buydown to lower interest rates. All these options help with affordability and make buying a home more achievable.

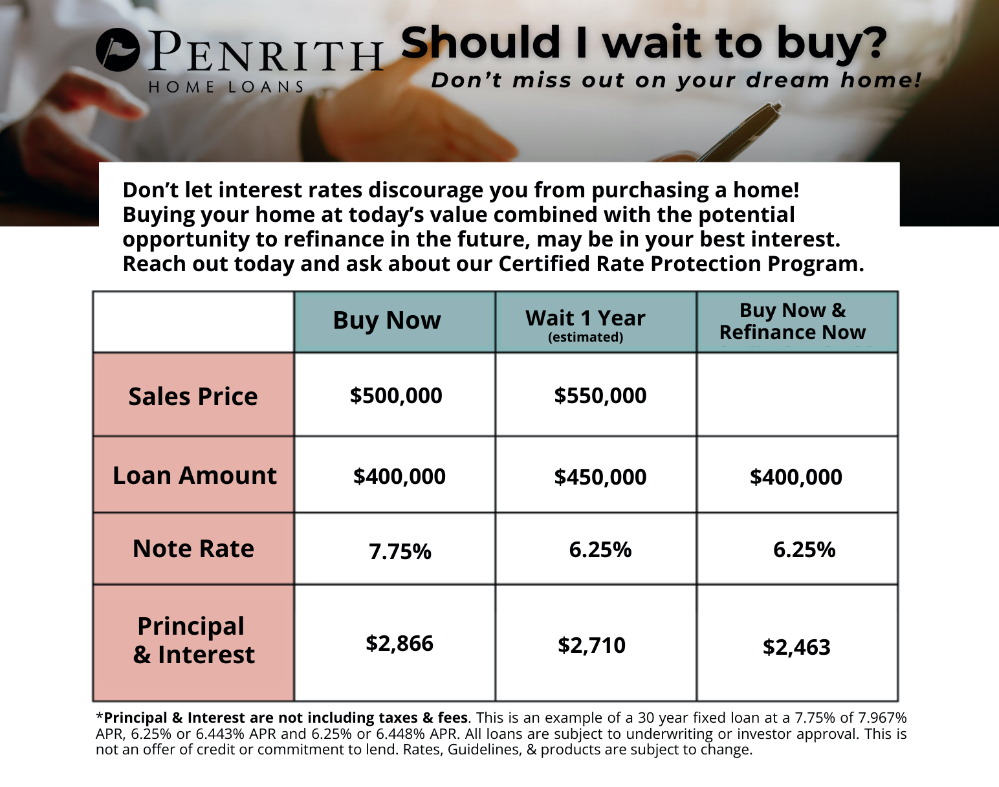

Are interest rates too high right now to buy a home?

Don’t let interest rates discourage you from purchasing a home. Buying your home at today’s value, combined with the potential opportunity to refinance in the future, may be in your best financial interest. As we say in real estate, marry the house, date the rate. If you wait to buy, most likely, the home’s value will continue to increase. This requires a larger loan regardless of the interest rate. If you buy now with a lower home value, you will have a smaller loan. With refinancing, this means a smaller monthly payment in the future.

Do I need to have a large down payment to buy a home?

If you’re saving up to buy your first home, you may be relieved to know that for most buyers, low down payment options are still available. This includes the following options:

- 0 down: The Veterans Administration and the U.S. Department of Agriculture both offer a zero-down loan program for individuals and/or properties that meet their criteria. Sometimes, loans require little or no cash out of pocket. Some down payment assistance programs also give buyers a chance to purchase with minimal down payment.

- 3.5% down: The Federal Housing Administration loan program allows as little as 3.5% down. This program is also more lenient than others on minimum credit score requirements and other factors.

- 5% down: Fannie Mae/Freddie Mac conventional loans are available with down payments as low as 3%. The minimum on these programs can change depending on factors such as property type, credit score, and occupancy. Conventional financing is now allowing as little as 5% down payment on a multi-family/2-4 family home, which will allow homeowners to occupy one unit and rent out the other units as cash flow, which offsets the expense of their monthly mortgage payment.

If you have additional questions about finances as a first-time home buyer, contact Cherie Kesti or one of our Windermere Kingston Brokers. We also have other great resources to help you, including our home-buying guide and what to examine when touring a home. Best wishes on your home-buying journey!

Kitsap Market News & Insights

While Kitsap County’s housing market isn’t seeing the intense engagement it saw at the height of the pandemic, it has been heating up this summer. We are seeing a shift toward a more balanced market, but the average home sale price still remains high at $694K, just a 1.6% drop from this same time last year. Our Brokers are still working with eager buyers and satisfied sellers, but there aren’t as many multiple-offer situations.

Matthew Gardner, Windermere’s Chief Economist, recently released his latest “Monday with Matthew” video. In it, he evaluates his 2023 real estate predictions. Have they come to fruition? Will these predictions come true in the second half of the year? Watch his video and keep reading for key takeaways.

Key Takeaways from Gardner’s Mid-Year Update

Gardner believes that interest rates will be less frantic in the second part of the year, but will likely still not drop below 6%. Also, he points out that according to his calculation, 20 million homeowners have mortgage rates around 3%, making it unlikely they will move. Known as the lock-in effect, the higher interest rates are disincentivizing some sellers from listing their homes.

Gardner states that “affordability has not improved,” since financing and home costs are not aligning with incomes. Noting that each market varies across the country, he predicted that it will generally stay a seller’s market through the rest of 2023.

Advice for Homebuyers in Kitsap County

What does this mean for buyers looking at homes for sale in Kitsap County? As always, it’s important to connect with a knowledgeable, local Realtor so that you can make data-informed decisions with an expert negotiator and guide. Also, it’s important to analyze the market and your current situation. So, consider these factors when deciding whether to buy a house now or wait. Each person’s financial picture and goals for owning a home are unique.

Advice for Sellers in Kitsap County

If you are thinking of selling your home here in Kitsap County, a local real estate expert will ensure that your home is thoughtfully and strategically prepared for the market. Also, they can conduct a Comparative Market Analysis (CMA). This report compares your home to other homes in the area that have recently sold and are similar in terms of size, property, and condition. A CMA will help you better understand your local market, the demand for homes like yours, and how to properly price your home. It’s also important to discuss repairs or potential home upgrades so you can sell your home for the highest price point possible in the ideal timeframe. If you’re concerned about the cost of home repairs and getting your home ready to sell, consider the Windermere Ready Program. This program allows you to access the equity in your home to cover improvement costs, and we’ve seen many sellers achieve success through this program.

Should You Renovate Or Sell Your Home As Is?

You’ve decided to sell your home, so should you renovate or sell your home as is? As with all decisions, there are pros and cons to each choice. If you choose to renovate your home, it will most likely sell for a higher price and faster, but remodeling projects can be costly. And, some don’t have a high return on investment. If you choose to sell your house as is, you save money in the short term but you could miss out on making more money on the sale of your home. It’s important to understand the factors involved and work with your real estate agent.

Home Remodel Cost Analysis

One of the most important factors is the cost of home remodeling projects. First, how much are you willing to spend? Second, can you expect a decent ROI when you sell your home? Thankfully, you don’t have to figure this out on your own. Your local real estate agent is a great resource and should be an expert on the local market. It’s their job to evaluate your home and to know which remodels are most beneficial in your area.

Doing A Home Remodel

If you decide to move forward with renovations, the next decision to make is whether you can DIY or if you need to hire a contractor. If you are qualified, can you dedicate the time required to finish the project within your home sale timeline? While hiring a contractor costs more, it may be worthwhile. You may want the peace of mind of working with a professional, especially for highly technical projects.

According to the Remodeling 2022 Cost vs. Value Report, on average, homeowners paid approximately $27,000 for a midrange bathroom remodel and it had a 58.9% ROI. For a minor kitchen remodel nationwide, they paid about $28,000 and it had a 71.2% ROI. These numbers indicate that you can recover more than half to a third of your costs. For your home, simpler upgrades that increase your home’s value may be better. Consider painting kitchen cabinets, refinishing hardwood floors, or installing new bathroom tile. After you’ve updated or renovated, your agent can help determine the price of your home.

Selling Your Home As Is

If you decide not to remodel your home, you may ultimately sell your home for less. But you won’t have to deal with the costs and headaches that come with renovations. Plus, remodeling a home you are about to sell means you won’t get to enjoy any of the upgraded benefits. Where’s the fun in that? Lastly, choosing not to remodel or make any upgrades will impact what you get for your home and your home-buying budget. It’s important to remember the costs of buying a new home.

Market Conditions

Local market conditions are another factor to consider when deciding whether to renovate or sell your home as is. In a seller’s market, you most likely will still be able to sell your home for a great price without investing time and money into remodeling. Due to strong demand and limited supply, high competition among buyers will drive up prices. However, you’ll still have to take steps to prepare like making necessary repairs. And, staging your home gives buyers a great first impression and helps them easily imagine themselves in the space. That being said, sometimes certain projects like adding stone veneer to your home’s exterior (119.5% recouped at resale) or replacing your garage door (117% recouped at resale) can really increase the value of your home.

Here in Kitsap County, we still have a seller’s market. Though we are seeing a shift in the market, there are still serious buyers. Watch our video below to see our 3rd quarter market stats.

Waiting

If you’re still not sure what to do and you’re not working within a tight timeline, you could wait. This will give you more time to weigh your options and prepare for a future sale. With more time, you’ll be able to plan for any needed projects at a more relaxed pace.

When deciding whether to renovate or sell your home as is, Windermere Kingston has highly rated, experienced local real estate experts available to help. Take some of the pressure off and contact us today.

Windermere Ready Program: Increase Your Home’s Sale Price

Preparing your home to make a great first impression is the best way to increase the sale price. The Windermere Ready program was created for home sellers to specifically address this important selling point. With guidance from a local expert, our program prepares your home to really impress potential buyers. And, if you need financial assistance, we can provide it so that you can make necessary home repairs and improvements.

Sell Faster and For More

In general, making necessary repairs and upgrades helps homes sell faster and for more money, sometimes even above the asking price. A great first impression transforms a buyer’s interest into excitement. Of course, every home is unique, but taking action is the key to success.

The Windermere Ready program provides:

- A personal, customized consultation

- A home plan designed specifically for your property

- Recommended high impact updates

- Professional staging

Overall, buyers want stylish, turnkey homes. Yet, some buyers also look for specific amenities and comforts. As a result, knowing what repairs and upgrades will result in the biggest return on your investment is challenging. That’s why the Windermere Ready program offers a personalized approach. One of our local real estate experts will work with you to identify the next steps while keeping your timeline and needs in mind.

After crucial repairs and key upgrades are determined, one of our Windermere Kingston real estate experts will create a customized action plan. Working with an experienced professional will help you avoid costly mistakes and make your life easier by recommending excellent local service providers and coordinating access to your home.

Make Improvements That Matter

For a buyer, sometimes small improvements make the biggest impact. A colorful garden and a fresh coat of paint give your home eye-catching curb appeal. Simple changes such as refinishing the flooring and making cosmetic updates provide a welcoming atmosphere and help make a house feel like home.

Simple improvements we focus on:

- Landscaping

- Lighting

- Decorative Window Features

- Painting

- Floor Repair/Refinishing

- Fixture Repair or Replacement

- Cosmetic Updates

Cleaning strategies we focus on:

- Window Washing

- Power Washing

- Carpet Cleaning/Replacement

- Decluttering

- Professional Deep Cleaning

Staging Your Home is the Finishing Touch

Make the most of your home repairs and updates by adding a finishing touch — staging your home. With the help of professional stagers, you can increase your home’s sale price. Staging is the final detail that leads to the best first impression and helps buyers picture themselves living there. In fact, staged homes sell 87% faster and for 17% more than non-staged homes.

We’re Invested in Your Success

If helpful, we can assist with expenses by providing a loan of up to $100,000. There are no upfront costs and no monthly payments during the six-month loan term. As soon as your home sells, the loan is paid off in one lump sum. For more details about how the Windermere Ready loan can help your home make the best first impression, please contact us today.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link