How to Financially Prepare as a First-Time Home Buyer

While there are many steps in the home-buying process, it’s best to start by reviewing your finances, especially as a first-time home buyer. In fact, you should do this long before you start looking at homes. While diving into your finances can feel daunting, our partner at Penrith Home Loans is here to help. Cherie Kesti is a Branch Manager and Mortgage Consultant who also happens to be a Kitsap County local. With more than 20 years of experience working in the home financing industry, she was happy to answer these common questions from first-time home buyers.

What are the top things lenders consider when working with a first-time home buyer?

There are a lot of things we look for when qualifying a first-time home buyer, but four key areas are:

- Job security: Having a minimum two-year history is ideal.

- Other income sources: This includes other sources such as social security, alimony, child support, disability, retirement, and pensions. For these types of income, lenders must confirm that the money will continue being received at least 36 months post-closing.

- Credit history and monthly debt load: Having a good credit score is an indicator of your overall financial health. If yours is low, it’s important to take steps to improve your credit score before applying for a loan. Also, the amount of outstanding debt directly affects how large a loan a buyer qualifies for. If you’re able to pay down your debt, that’s ideal before qualifying for a loan.

- Assets: Some loans require a minimum amount of assets in liquid accounts such as checking, savings, and money market accounts or in brokerage, retirement, and stocks. Borrowed funds are not considered an acceptable source of funds for a home loan unless those funds are secured by an asset such as a vehicle, or property.

Is buying a home still achievable in today’s market?

Many young adults think that they may never be able to buy a home. There is so much discouraging information in the media. However, they become more optimistic after learning that there are a variety of lending strategies and programs available to help first-time home buyers. This includes programs that allow a small down payment and gift funds from a family member to be used as a down payment. There is also down payment assistance available and the possibility of negotiating a seller-paid mortgage-rate buydown to lower interest rates. All these options help with affordability and make buying a home more achievable.

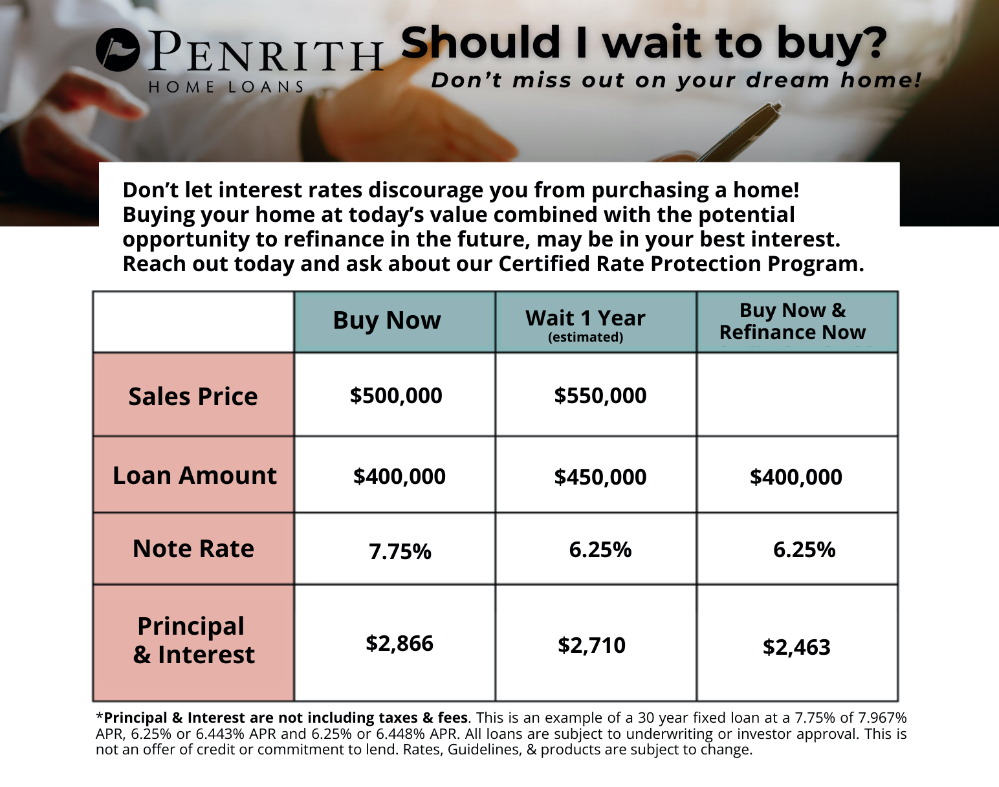

Are interest rates too high right now to buy a home?

Don’t let interest rates discourage you from purchasing a home. Buying your home at today’s value, combined with the potential opportunity to refinance in the future, may be in your best financial interest. As we say in real estate, marry the house, date the rate. If you wait to buy, most likely, the home’s value will continue to increase. This requires a larger loan regardless of the interest rate. If you buy now with a lower home value, you will have a smaller loan. With refinancing, this means a smaller monthly payment in the future.

Do I need to have a large down payment to buy a home?

If you’re saving up to buy your first home, you may be relieved to know that for most buyers, low down payment options are still available. This includes the following options:

- 0 down: The Veterans Administration and the U.S. Department of Agriculture both offer a zero-down loan program for individuals and/or properties that meet their criteria. Sometimes, loans require little or no cash out of pocket. Some down payment assistance programs also give buyers a chance to purchase with minimal down payment.

- 3.5% down: The Federal Housing Administration loan program allows as little as 3.5% down. This program is also more lenient than others on minimum credit score requirements and other factors.

- 5% down: Fannie Mae/Freddie Mac conventional loans are available with down payments as low as 3%. The minimum on these programs can change depending on factors such as property type, credit score, and occupancy. Conventional financing is now allowing as little as 5% down payment on a multi-family/2-4 family home, which will allow homeowners to occupy one unit and rent out the other units as cash flow, which offsets the expense of their monthly mortgage payment.

If you have additional questions about finances as a first-time home buyer, contact Cherie Kesti or one of our Windermere Kingston Brokers. We also have other great resources to help you, including our home-buying guide and what to examine when touring a home. Best wishes on your home-buying journey!

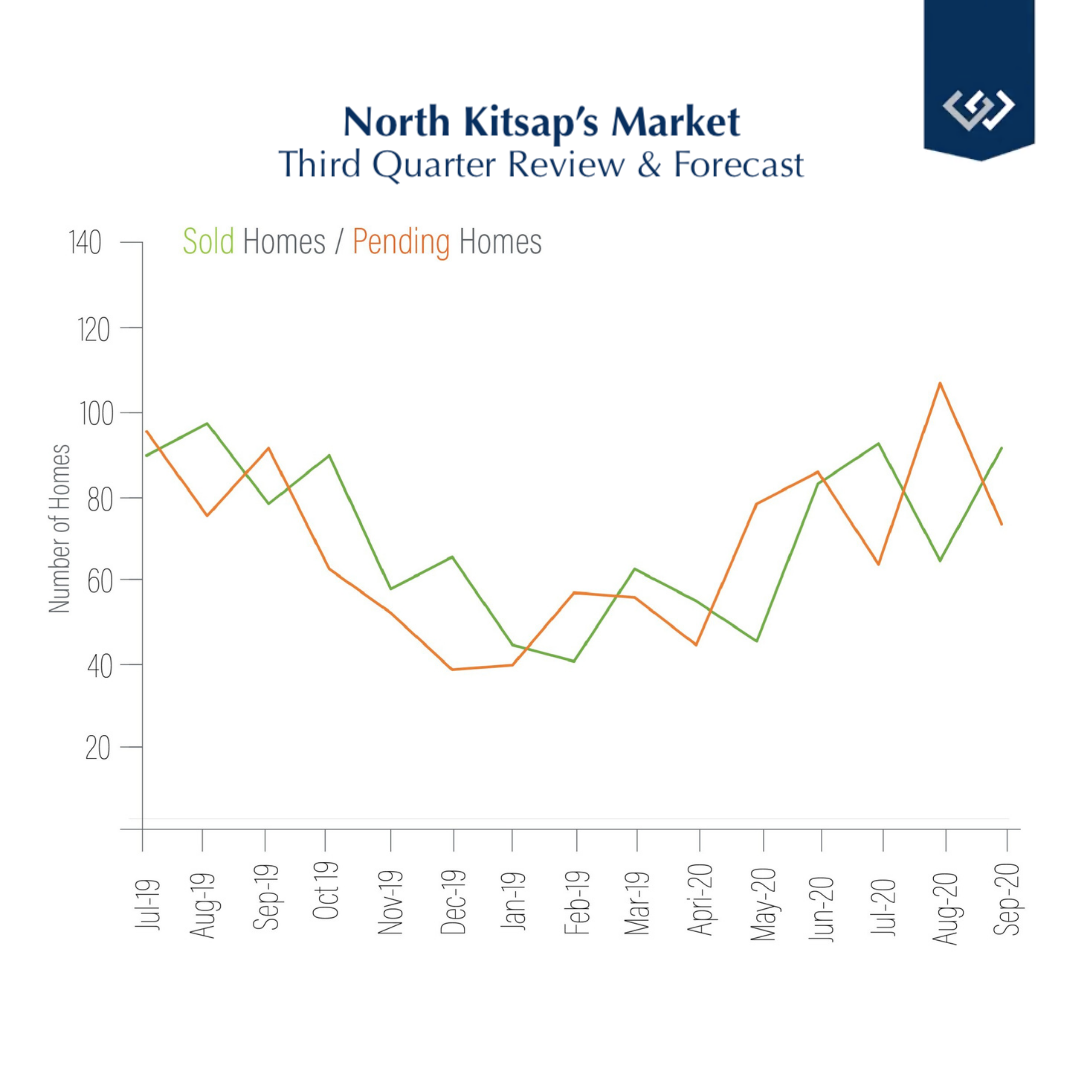

North Kitsap’s Market: Third Quarter Review and Forecast

North Kitsap’s market had a very strong third quarter. We’ve compiled key stats below to provide a comprehensive review of our market, as well as insights and predictions from Windermere Real Estate’s Chief Economist, Matthew Gardner.

Our Strong Seller’s Market

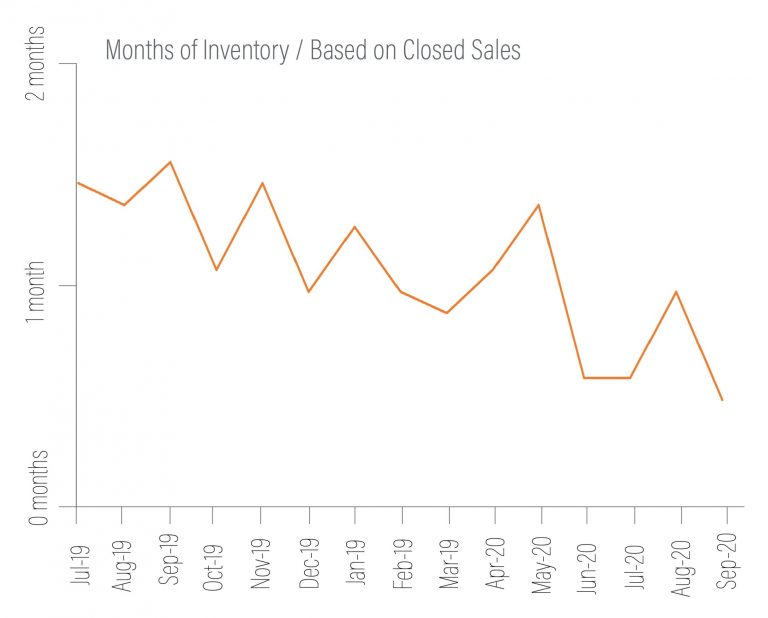

It’s a strong seller’s market here in North Kitsap. Inventory remains low while demand is high. In our third quarter, the median sale price was up 9% year-over-year at $508K. Buyers should be aware that multiple offer situations have become more common in our area. Our Brokers have seen an increase in situations where some buyers are outbid either by price or by an all-cash buyer.

Market Predictions

Although mortgage rates remain historically low and demand is high, our Chief Economist, Matthew Gardner, has some concerns about how this may impact real estate down the road. “We may be heading towards a period where we see houses turn over at a far slower pace as we stay in our homes for longer than ever…this could be a problem as it leads to persistently low levels of inventory for sale, which itself could lead to prices continuing to rise at above-average rates and that would further hit affordability.” As for mortgage rates, Gardner does not expect them to rise significantly any time soon. However, he says, “We should all be aware that there could be consequences to very low rates”.

Western Washington Review

Let’s zoom out a bit and look at our area. Below are highlights from The Western Washington Gardner Report provided by Windermere Real Estate’s Chief Economist, Matthew Gardner.

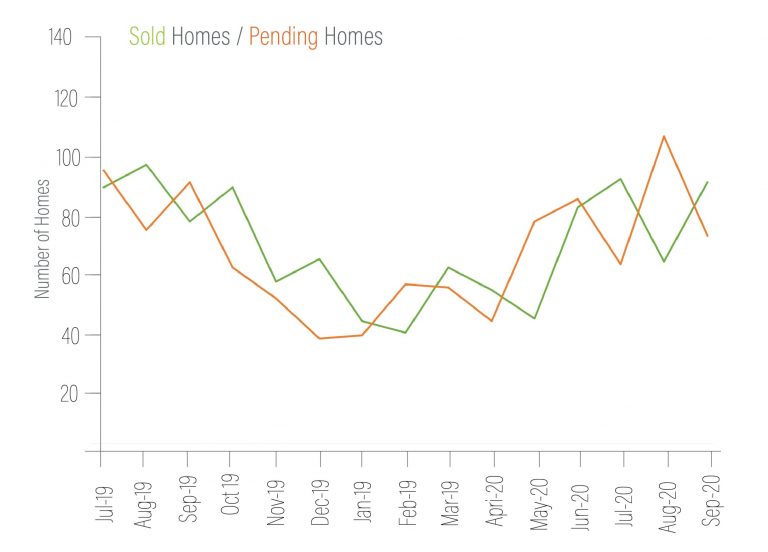

WESTERN WASHINGTON HOME SALES

- Total Sales: 11.6% increase from Q3/2019, and 45.9% higher than Q2/2020

- Homes for Sale: 41.7% lower than Q3/2019, but up 1.6% from Q2/2020

- Pending Sales: up 29% from Q2/2020

WESTERN WASHINGTON HOME PRICES

- Average: $611,793 (up 17.1% from Q3/2019). Low mortgage rates and limited inventory are clearly pushing prices up.

- Prices will continue to increase as long as mortgage rates and inventory levels stay low. If this continues to be the case, affordability issues will become more apparent in many markets.

DAYS ON MARKET, WESTERN WASHINGTON

- Average: 36 days (an average of 4 fewer days than in Q2/2020 and 2 fewer days than in Q3/2019)

- In Kitsap County, average days on market: 20

Conclusion

In Gardner’s Western Washington Report, he states that, although we have a strong seller’s market that is very buoyant, he’s “starting to see affordability issues increase in many areas—not just in the central Puget Sound region—and this is concerning. Perhaps the winter will act to cool the market, but something is telling me we shouldn’t count on it.”

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link